Debt Consolidation Loans for Homeowners

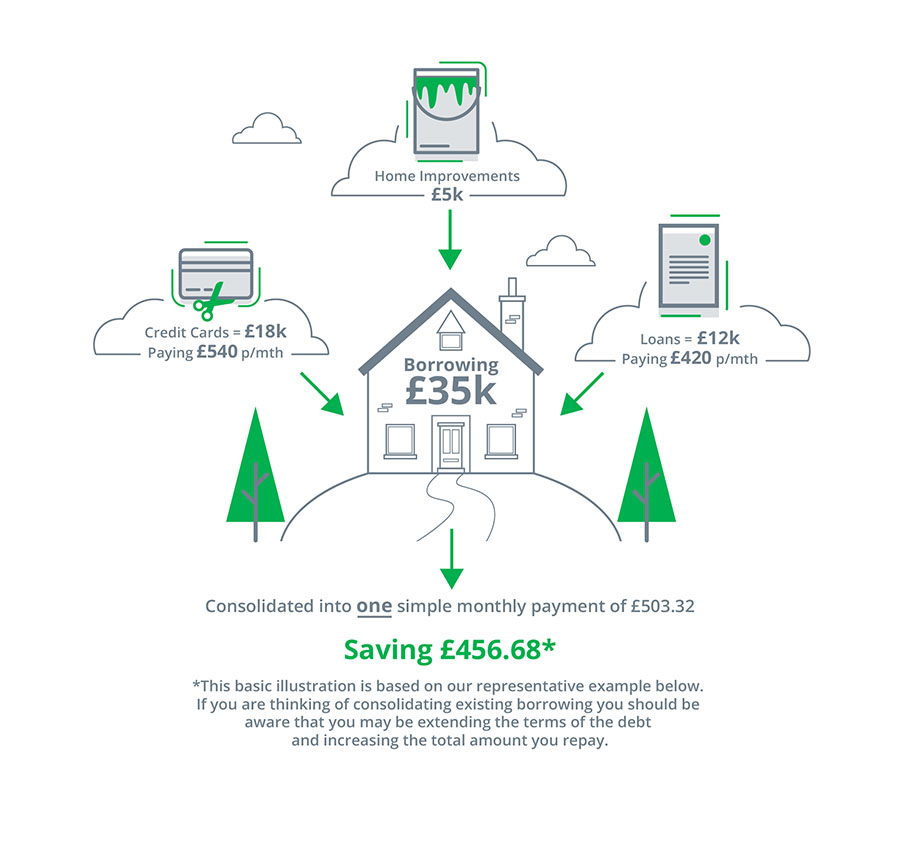

Debt consolidation loans can make your life simpler and potentially save you a lot of money each month. We can help you consolidate some or all your total debts into one, more manageable homeowner loan. Today's the day to start managing your debt in a way that suits you!

Time to Consolidate your Debts

Homeowner Consolidation Loans

As a Homeowner you can access secured debt consolidation loans. Giving you the opportunity to combine your debts together, reduce your outgoings and have one simple payment.

We will find the very best solution, from our panel of specialist lenders.

Are Secured Loans Easier to Get

You are more likely to be accepted for a secured loan because the lenders are using your home as security.

A secured debt consolidation loan could help you take control of your repayments and repair your credit rating.

Secured Loan to Pay Off Credit Cards

Becoming over indebted to credit cards can have a negative impact on your credit score & if you’re only paying minimum payments, then your balances will hardly be reducing.

Improve your credit file and reduce your outgoings by taking a secured consolidation loan.

Fast Homeowner Loans

Are all those debts due out again at the end of the month? We find the perfect Homeowner Loans and get them funded.

Ideally, we’ll get the loan completed before your next lot of creditor monthly payments become due.

Award Winning

We’re delighted to be winners of the Corporate LiveWire Global Awards 2022-23

“Mortgage Broker of the Year”

It was great to be shortlisted as a finalist for the BIBAs 2022 category

“Start Up Business of the Year”

We are proud to be winners of the SME News Financial Awards 2021 category

“Most Trusted Mortgage Broker - North West England”

Free Credit Report

Your credit score can certainly impact your choice of loan options, as lenders use it to get a better understanding of your financial history and the likelihood of you defaulting on your loan.

Get the only Credit Report that checks data from Equifax, Experian and TransUnion. Try it FREE for 30 days, then £14.99 a month – cancel online anytime. Click the link below to get started.

Simple Secured Loans

Representative Example Secured Loans:

Based on borrowing £35,000 over 120 months (10 years). Interest Rate: 10.50% fixed for 60 months

(5 years) with instalments of £503.32. Followed by 60 months (5 years) at the lenders standard variable rate of 10.50% with instalments of £503.32. Fees: Broker fee (£1,000); Lender fee (£1,295). Total amount payable £60,398.40. Comprised of; loan amount (£35,000); interest (£25,398.40) including broker fee and lender fee. Overall cost of comparison 12.80% APRC.

This means 51% or more of our clients receives this rate or better for this type of product.

We are a broker not a lender.

If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.