Bridging Loan Broker

We arrange fast, flexible bridging loans when timing is critical. Ideal for auction purchases or urgent completions. We keep you informed, move fast and stay focused on securing the best outcome for your case.

Bridging Finance Solutions

Best Bridging Loans

We are dedicated to finding the best available bridging loans at the lowest overall cost.

Our team will guide you through the process and then find the best bridging loan for your circumstances.

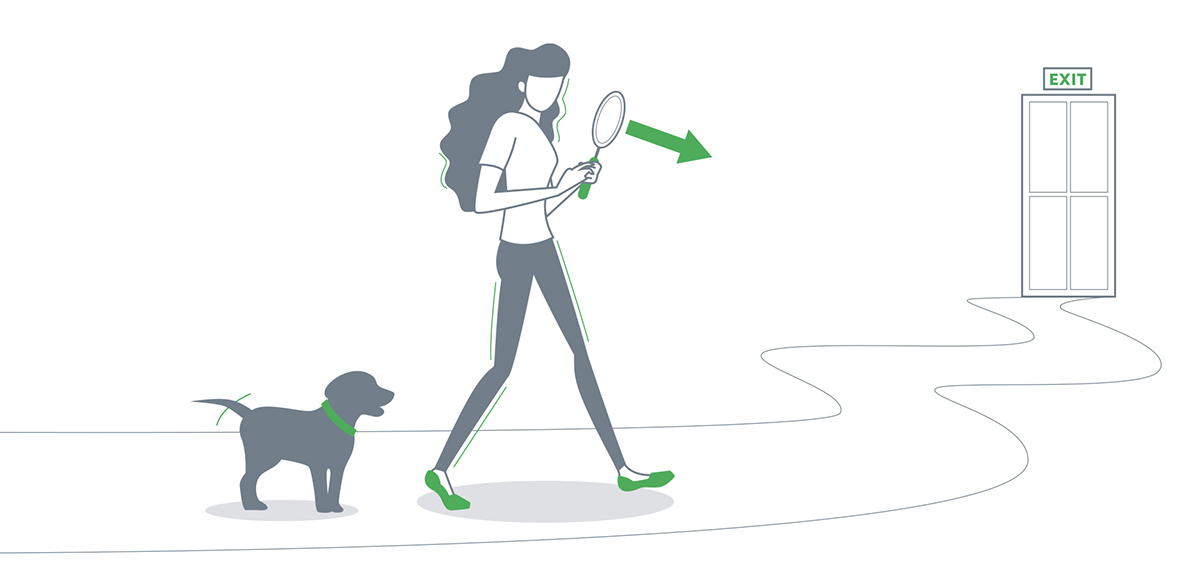

Bridging Loan Exit Strategy

An exit strategy is one of the most vital parts of your bridging loan application. Your ability to repay the loan is a primary factor in determining your eligibility for the loan. Your exit strategy must be credible and realistic. It should determine how much you want to borrow and over what time frame. Lenders will consider a range of acceptable exit plans and in most cases, it will be either be to resell or refinance the security property. Exit strategies can include:

- Sale of security property

- Refinance to a long-term mortgage

- Sale of secondary property

- Cash redemption from inheritance

- Cash redemption from pension

- Sale of shares or investments

- Sale of other assets